Navigating the Quantum Computing Landscape: The Impact of AI on Investment Valuations

The Quantum Computing Investment Dilemma: AI’s Growing Shadow Over Hardware Players

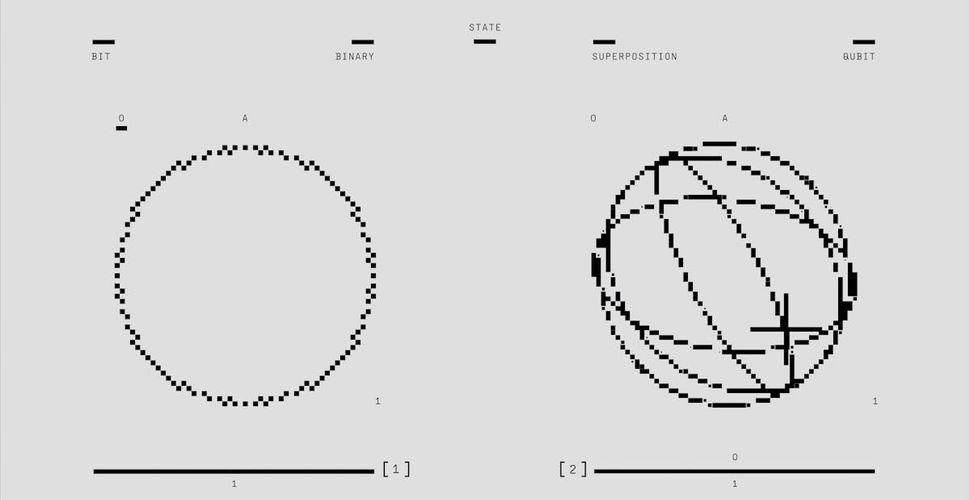

Quantum computing has long been heralded as the next frontier in technological advancement, promising breakthroughs in fields ranging from cryptography to materials science. However, as the sector garners increasing investor interest, a deeper examination reveals a landscape fraught with overvaluation and looming competition from artificial intelligence (AI) innovations. This comprehensive analysis delves into the current state of the quantum computing market, evaluates the sustainability of its valuations, and explores the emerging challenges posed by AI advancements.

Key Market Overview

The quantum computing sector has emerged as a hotbed for investment, attracting significant capital from both institutional and retail investors. Leading the charge in public markets are companies such as IonQ, Rigetti Computing, and D-Wave Quantum, each striving to capitalize on the anticipated quantum revolution. These firms have positioned themselves at the forefront of quantum technology, leveraging unique approaches like trapped ion qubits and quantum annealing to differentiate their offerings.

Despite the enthusiasm, a critical analysis uncovers potential pitfalls. The sector’s rapid valuation escalation appears disconnected from tangible commercial progress, raising concerns about bubble-like conditions. Furthermore, advancements in AI technology threaten to overshadow the unique value propositions of quantum hardware, potentially rendering some quantum solutions redundant or less competitive in the long run.

Valuation Concerns

One of the most pressing issues facing quantum computing companies is their exorbitant market valuations, which significantly outpace established industry benchmarks. The current valuation metrics highlight a troubling disparity between investor expectations and the underlying financial realities of these firms:

- IonQ presents a Simple Valuation Ratio (SVR) of 103x, a staggering multiple that suggests an overvaluation when compared to traditional tech benchmarks.

- D-Wave Quantum exhibits an SVR of 36x, indicating a more moderate yet still concerning level of market enthusiasm.

- Rigetti Computing holds the lowest SVR among the trio, yet it remains substantially overvalued, reflecting investor optimism that may not align with its financial performance.

For context, industry leader Nvidia trades at an SVR of approximately 30x, while the tech sector catalog average hovers around 6x. This comparison underscores the disproportionate valuations seen in the quantum computing space, signaling potential risks for investors seeking sustainable growth.

The inflated valuations of these quantum firms are often justified by speculative future potential rather than current revenue and profitability metrics. Such high multiples imply expectations of exponential growth and market dominance, which may be unrealistic given the nascent stage of quantum technology commercialization.

Revenue Reality Check

While market valuations paint an optimistic picture, the reality of revenue generation within quantum computing companies tells a different story. A closer examination of the financial performance of key players reveals significant challenges in achieving sustainable income streams.

Rigetti Computing

Rigetti Computing, despite being the least overvalued among its peers, faces substantial headwinds:

- Revenue Growth: The company’s revenue growth has stagnated, with recent quarters showing a decline. This trend raises concerns about its ability to scale operations and attract new business.

- Customer Concentration: A disproportionate 73% of Rigetti’s revenue is derived from just five major customers. This high concentration risk makes the company vulnerable to client attrition and market fluctuations.

- Government Dependency: Over 90% of Rigetti’s revenue is dependent on government contracts. While government funding can provide stability, it also ties the company’s fortunes to public sector budget allocations and policy priorities, limiting flexibility and diversification.

D-Wave Quantum

D-Wave Quantum exhibits a similarly troubled revenue landscape:

- Revenue Benchmarks: The company’s annual revenue remains below the meaningful threshold of $10M, reflecting minimal commercial traction despite its pioneering efforts in quantum annealing technology.

- Valuation vs. Traction: Despite generating relatively low revenue, D-Wave’s valuation remains high, indicating a potential disconnect between market valuation and actual business performance. This imbalance suggests that investor confidence may be based more on technological promise than on current financial health.

IonQ

IonQ presents a more optimistic yet still questionable revenue projection:

- Projected Growth: The company is forecasting an 84% revenue growth for the current year, building on a $22M base. While impressive on paper, sustaining such high growth rates is challenging, especially in a highly competitive and speculative market.

- SPAC Projections: Following its merger with a Special Purpose Acquisition Company (SPAC), IonQ has projected $230M in revenue for the next year. These projections are ambitious and may be overly optimistic given current market conditions and the company’s execution capabilities.

- Valuation Comparison: Utilizing Nvidia’s SVR of 30x, IonQ’s stock would theoretically trade at $6.90 per share. However, the company’s current market capitalization stands at $5B, suggesting that its valuation by investors is excessively inflated when evaluated against more established industry standards.

The disparity between IonQ’s projected revenues and its market cap underscores the skepticism surrounding the sustainability of current valuations in the quantum computing sector.

The AI Challenge

Amid the quantum computing race, AI advancements are emerging as a formidable competitor, potentially diminishing the strategic advantages that quantum hardware firms aim to offer. Recent developments indicate that AI may not only parallel but also surpass quantum computing in solving complex problems more efficiently.

-

AI’s Expanding Capabilities: The MIT Technology Review highlights how AI is making significant strides in areas traditionally targeted by quantum computing, such as physics simulations, chemical reaction modeling, and material science innovations. AI’s ability to process large datasets and identify patterns offers a versatile toolset that can address many of the same challenges quantum computers aim to solve.

-

Performance Disparities: Research conducted by Matthias Troyer demonstrates that quantum hardware currently operates at speeds that are orders of magnitude slower than modern computer chips. This speed disadvantage undermines the theoretical processing power of quantum systems, making them less practical for real-world applications where speed is paramount.

-

Machine Learning Solutions: Machine learning (ML) approaches are showing promising results in tackling complex quantum problems. These AI-driven solutions can often provide faster and more cost-effective alternatives to quantum computing, challenging the necessity and appeal of investing heavily in quantum hardware.

“The theoretical advantages of quantum computing disappear if you account for the fact that quantum hardware operates orders of magnitude slower than modern computer chips.” - Research findings

The implications of these developments are significant. If AI continues to advance and address complex problems more efficiently than quantum computers, the investment thesis supporting quantum hardware may need to be reevaluated. Investors must consider the possibility that AI could offer a more scalable and economically viable solution, potentially diminishing the market demand for quantum computing services.

Competitive Landscape

The quantum computing arena, particularly within the Trapped Ion Quantum Computing segment, is becoming increasingly crowded as more players enter the field. This intensifying competition could dilute market share and increase the difficulty of achieving a sustainable competitive advantage.

-

AQT (Alpine Quantum Technologies): AQT is making strides with its trapped ion technology, focusing on building scalable quantum systems and contributing to the broader ecosystem through collaborations and research initiatives.

-

Oxford Ionix: Based in the UK, Oxford Ionix leverages its academic and research prowess to develop advanced quantum technologies, positioning itself as a significant contender in the European quantum market.

-

Research Institutions: Numerous academic and research institutions are actively engaged in breakthrough quantum computing research. These entities contribute to the rapid pace of innovation but also heighten the competitive pressure on commercial quantum computing firms to translate research into viable products and services.

The proliferation of competitors in the trapped ion space underscores the challenges of differentiating products and securing a loyal customer base. As more companies vie for dominance, the risk of market saturation increases, potentially leading to pricing pressures and reduced margins.

Investment Considerations

Investing in the quantum computing sector presents a unique set of opportunities and risks. Prospective investors must navigate a complex landscape where high valuations meet uncertain commercial prospects and emerging technological threats.

Risk Factors

-

Excessive Valuations Disconnected from Fundamentals: The inflated market valuations of quantum computing companies are not supported by their current financial performance. This disconnect raises the risk of significant price corrections if growth expectations are not met.

-

AI Potentially Disrupting Quantum Computing’s Value Proposition: As AI technologies advance, they may address many of the complex problems that quantum computing aims to solve, potentially rendering some quantum solutions obsolete or less competitive.

-

Slow Commercial Adoption: Quantum computing is still in its early stages of commercialization. The slow pace of adoption could delay revenue growth and prolong the period before these companies achieve profitability.

-

Heavy Reliance on Government Contracts: Many quantum computing firms depend heavily on government contracts for revenue. This reliance introduces vulnerability to changes in public funding priorities and budget allocations, which can impact financial stability.

Key Metrics to Monitor

Investors should focus on specific metrics to assess the health and potential of quantum computing companies:

-

Sequential Revenue Growth Rates: Monitoring the quarter-over-quarter or year-over-year revenue growth provides insights into the company’s ability to scale its business and capture market share.

-

Commercial Customer Acquisition: The rate at which companies are acquiring new commercial customers indicates market acceptance and the effectiveness of sales and marketing strategies.

-

Hardware Performance Improvements: Advancements in quantum hardware performance, such as qubit fidelity, coherence times, and error rates, are critical for maintaining competitive advantage and achieving practical applications.

-

AI Advancement in Quantum Problem-Solving: Tracking the progress of AI in solving problems traditionally targeted by quantum computing can help assess the long-term viability of the quantum investment thesis.

Key Takeaway: While quantum computing holds promise for revolutionizing several industries, the current public market valuations of quantum hardware companies appear unsustainable when evaluated against their financial fundamentals. Additionally, the rapid advancements in AI technology present a significant competitive threat, potentially undermining the unique value propositions of quantum computing. Investors should approach the sector with caution, carefully weighing the high-growth potential against the substantial risks posed by overvaluation and technological disruption.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. All trading and investment decisions should be made based on your own research, experience, and risk tolerance.

Comments